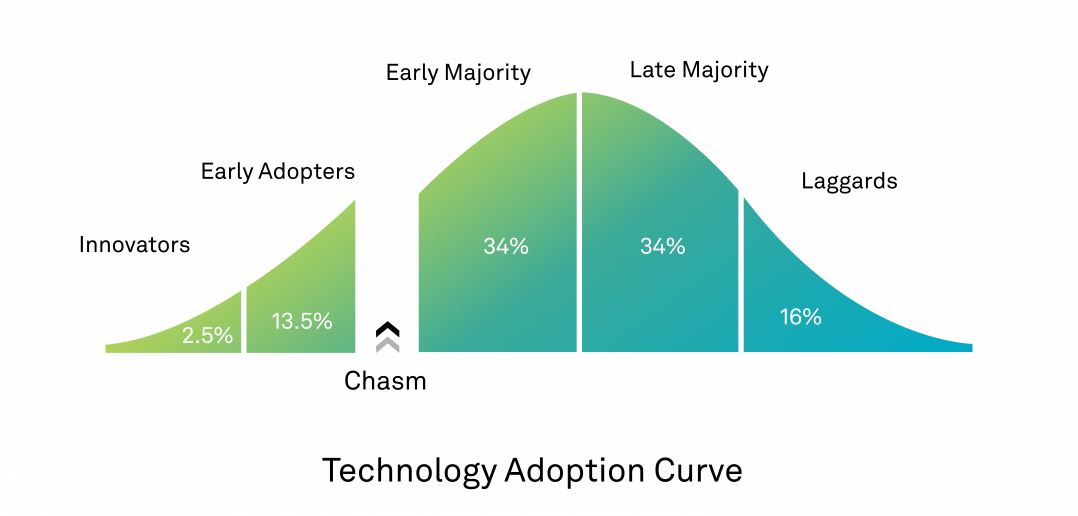

The journey of new technology adoption is much like a race. Some are quick off the starting line, eager to try the latest gadgets and systems. Then there are those who — while not the first — are not far behind. Following them are the cautious ones, those who wait a little longer to ensure the change is worth their time. Bringing up the rear, we have the latecomers who cling to the familiar unless change is absolutely necessary.

This race is what sociologist Everett M. Rogers called the “diffusion of innovations” back in 1962. And it’s not just about gadgets. It’s a key concept in understanding how new ways of doing things catch on — or don’t.

Now, imagine we’re talking about autonomous technology in the construction world. The race analogy can help us determine how quickly the industry is embracing this new tech. It can tell us if it will become the new normal and help construction companies decide where to invest their money in a world that’s changing faster than ever.

Let’s look further at the categories of participants in the technology adoption curve.

- Innovators (2.5%): These are the first to adopt new technology. They’re often risk-takers and understand the potential benefits of new technologies.

- Early adopters (13.5%): This group is more selective than innovators yet still eager to adopt new technology. They usually have strong industry connections and can influence others, making them vital to driving broad adoption.

- Early majority (34%): After careful consideration and analysis, the early majority will adopt new technology. They wait to see successful implementation by others before committing, ensuring that any initial issues have been resolved.

- Late majority (34%): This group is more sceptical and requires substantial proof of benefits before adopting new technology. They adopt technology only when it becomes an industry standard or when they see a clear competitive disadvantage in not doing so.

- Laggards (16%): Laggards are the last to adopt new technology, due to resistance to change, lack of awareness or limited resources. This group may eventually adopt the technology when it’s already outdated or when they face significant external pressure.

The “chasm” represents a challenging phase for emerging technologies as they struggle to transition from innovators and early adopters to the mainstream market. Crossing the chasm is essential for a new technology to achieve widespread use. Yet, many new technologies fail to make this leap and fizzle out, even if they initially generated enthusiasm in the early market.

Current penetration and adoption of autonomous solutions in construction

Through a survey of over 1,000 technology leaders from general contractor (GC) construction firms across North America, the United Kingdom and Australia, Hexagon discovered that autonomous technology has undoubtedly hit the gas pedal in the race to adoption. It has crossed the finish line into widespread use, leaving any doubts in the dust. In fact, 84% of firms today incorporate autonomy in their tasks, processes, equipment or systems.

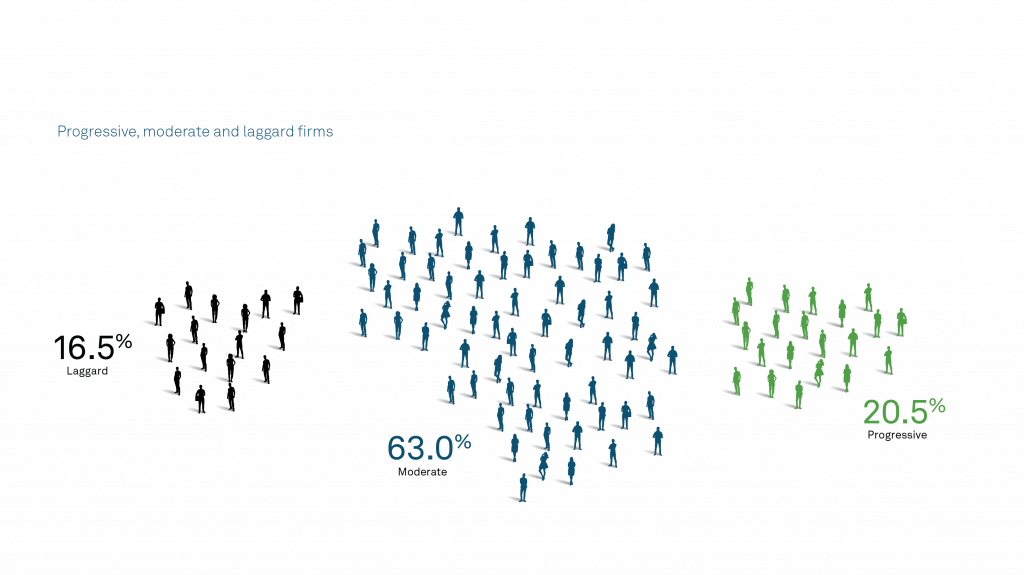

To understand where the industry is in its adoption of autonomy, we condensed and reclassified these firms into three categories: progressive, moderate and laggard.

Most construction firms (63%) are moderates, meaning they have begun to adopt autonomy in specific areas of their business but are still mainly using autonomous technologies to supplement human activity.

Coming in at 20.5% are progressive firms, which use four or more autonomous or automated systems within their operations and are more likely to use technologies with full autonomy. As expected, this group experiences enhanced benefits in their firms, such as improved sustainability and heightened safety compliance, compared to their moderate counterparts.

Only 16.5% of construction firms have yet to adopt autonomy, indicating that laggards risk getting left behind by their competition. Interestingly, this figure mirrors the latecomer percentage from the technology adoption curve discussed earlier.

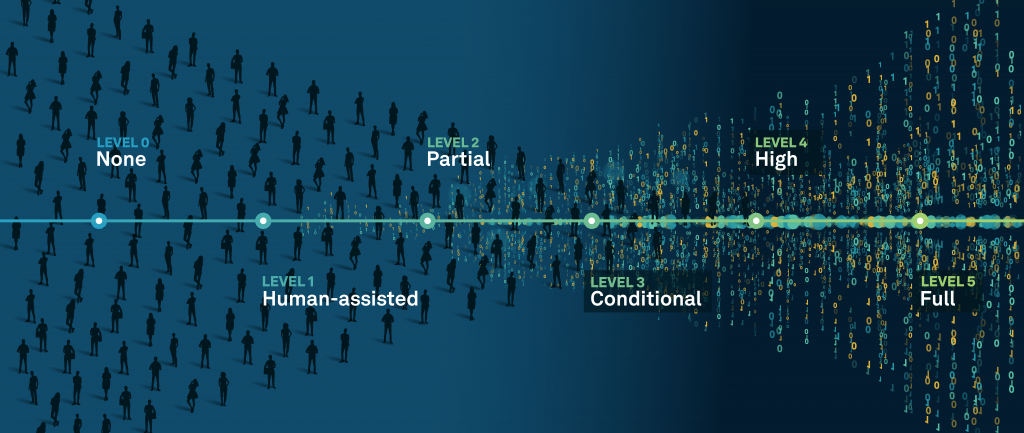

Autonomous technology levels in construction

Among the autonomous technologies used by construction firms, almost 47% are partially or conditionally autonomous. One example of this level of autonomy is a progress-monitoring platform like Avvir, which uses artificial intelligence (AI) to analyse images, track progress and compare building information modelling (BIM) with laser scans of existing conditions to detect discrepancies between design intent and actual construction. The platform requires initial input on what to search for and what is considered “correct” based on the model, after which it can automate the analysis of images to identify deviations. While the software automates the time-consuming aspects of the task, human intervention is still necessary to confirm the findings and take appropriate action.

Of the autonomous technologies surveyed firms use, 23% and 30% are split between limited and full autonomy, respectively. Autonomous technology types vary from workflow automation to fully autonomous robotics that can safely navigate remote or hazardous locations without endangering human operators.

Where are construction firms implementing automation in their operations?

Project management workflows represent the most automated area in construction firms, while the adoption of fully autonomous robotics remains relatively low.

About 31% of firms indicated that they use automation in project management workflows. This category includes billing, change management, daily report data, delivery schedules, logistics management, materials requisition and allocation, resource management, scheduling, subcontractor management, time tracking, tool tracking/maintenance/calibration and work packaging.

Other areas in which firms have adopted autonomous technology include workplace safety (28%), quality checks (26%), surveying (26%) and verification (25%).

In contrast, only 16.5% of respondents reported utilising fully autonomous robotics — such as reality capture robots like the BLK ARC and BLK2Fly — in their operations.

The future of autonomous construction

As the construction industry embraces autonomous technologies, we can expect further advancements in sustainability, cross-functional collaboration and safety compliance — among many other benefits. With increasing adoption rates, firms can complete projects faster and with fewer errors, enhancing the industry’s overall performance.

The landscape of autonomous construction is rapidly changing, and maintaining competitiveness necessitates embracing and investing in innovative technologies. By understanding the technology adoption curve and its implications, firms can better position themselves for success in the increasingly automated world of construction.

Learn more about the state of autonomous construction and its benefits in Hexagon’s Autonomous Construction Tech Outlook, “Achieving better project outcomes through autonomy.”